Confirmation of the type of activity in social insurance. When do you need to confirm your main activity? How to confirm the main type of economic activity

Existing legal norms establish the obligation for a business entity to annually confirm the type of main activity. This procedure must be completed in order to assign a tariff rate for accident insurance to the Social Insurance Fund. This can be done using a form - a certificate confirming the main type of activity in the Social Insurance Fund.

Confirmation of the main type of activity must be carried out at the end of the year when the enterprise’s financial statements are compiled. This action must be done by all persons registered with the Federal Tax Service as legal entities, even if they were created at the end of the year (FSS order No. 55 of January 31, 2006).

In a situation where a business entity does not carry out any economic activity, it is still required to send a confirmation certificate in accordance with current legislation.

A certificate confirming the main type of economic activity in 2017 is not submitted only by legal entities that will be registered in 2018. For this category of company, the injury code is assigned according to the type of activity that was indicated during registration as the main one.

Current legal norms determine for individual entrepreneurs (with and without employees) a different process for confirming their activities. These persons can carry out this procedure at their own discretion. If the individual entrepreneur does not send a confirmation certificate, then the FSS considers the main type of activity to be the one indicated in the registration documents.

When an entrepreneur changes the direction of his business, he can send a similar application to social insurance. However, such an obligation is not provided for him. In this case, the entrepreneur must understand that if the production risk decreases due to a change in the direction of activity, the Social Insurance Fund will not independently recalculate the previously established injury rate. To reduce it if necessary, you need to submit a confirmation certificate for the new main type to social insurance.

Attention! PE insurance is mandatory only in relation to employment agreements. If a company has contracts for contract work or the provision of services, then it should make deductions only if they expressly indicate this obligation.

Why is it necessary to take it?

The importance of providing a confirmation certificate is due to the need to correctly determine the production risk for the organization. After all, on the basis of it, compulsory injury insurance is carried out, as well as the calculation of monthly insurance premiums.

If the business entity does not submit the specified documents to the social insurance authorities, the fund will set the percentage of insurance premiums at the maximum value, which will lead to an increase in the burden on the enterprise.

Deadlines for submitting certificates in 2019

The provisions of legislative acts establish that a confirmation certificate for the main activity must be submitted no later than the fifteenth of April following the reporting year. This is due to the fact that when compiling it you will need to use the information contained in the annual financial report.

Thus, companies must send documents for 2018 to the Social Insurance Fund no later than April 15, 2019. At the same time, no transfers of dates due to them falling on rest days or holidays are provided. This deadline in 2019 does not fall on a weekend, so the deadline for submitting a confirmation certificate next year will also be April 15, 2019.

However, this is the opinion of representatives of the FSS. And if the company sends the certificate on April 16, it will most likely be able to defend its point of view in court.

Attention! The confirmation certificate can be sent earlier, starting from the very beginning of the year. After receiving it, if the FSS body decides to change the tariff, it must notify the policyholder about this by May 1.

Methods for submitting documents

You can submit an application for confirmation of activity and a certificate in one of the following ways:

- Personally to the FSS employee by the head or his authorized representative;

- Send documents by post or courier service;

- Submit in electronic format using the State Services website.

If the documents are submitted by a representative of the organization, then he needs to have a power of attorney in hand to perform this action. Submission of these documents in electronic format is not provided through the popular ones - “Sbis”, “Kontur-Extern”, etc. For these purposes, you only need to use the “State Services” website.

If the organization does not yet have an account on it, then you must first register the director as an individual, confirm it, and only after that register the company from under him.

Confirmation of registration can be performed using an enhanced digital signature, which can be issued at the nearest certification center. In the future, you will be able to access the portal using it.

Attention! Several organizations can be registered on one manager account. However, for each of them there must be a .

A certificate in paper form can be submitted only when the average number of people is no more than 20 people. Companies with a higher number of employees must transfer a package of documents only electronically. In this case, paper forms will not be accepted, and ignoring this fact will be regarded as failure to provide a certificate with appropriate consequences.

Documents that need to be sent to the FSS

To carry out the procedure for confirming the type of activity, you need to prepare the following documents:

- Certificate confirming the main type;

- Application for confirmation of type of activity.

- A copy of the explanatory note to.

If the organization does not have the status of a small enterprise, then an explanatory note to the reporting is also attached to the application.

The forms for the confirmation certificate and application have not changed. Therefore, in 2018, the same document formats must be used to complete the procedure.

An economic entity can determine the form of explanation for itself independently. It can be in the form of a text document or a table.

Attention! Since 2017, new OKVED2 codes have been used in the country. Despite the fact that the documents mention the old directory, when confirming the type for 2017, it is necessary to use the new one.

Download the certificate and application form for 2019

Sample of filling out the certificate

First, let's look at how to fill out a certificate confirming the type of activity. Using the information specified in it, an application will then be drawn up.

After the designation of the document with which the form was entered, the date of preparation of the certificate is recorded.

Further, after the title of the form, information about the enterprise is indicated line by line: full name, date of registration, start date of activity, full name. responsible persons and others. All lines are numbered from 1 to 8 and contain a description of what information to record.

In lines 1-7 you must indicate information according to the constituent documents:

- Company name and tax identification number.

- Registration date.

- Start date of business.

- Legal address of the company.

- Information about the director and chief accountant.

In line 8 you need to indicate the average number of employees for the reporting year.

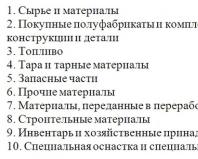

Then comes a table in which you need to break down income by type of activity:

- Column 1 indicates the code of the type of activity, column 2 - its text name.

- Column 3 records revenue for this type for the past year excluding VAT.

- In column 4 you need to enter the amounts of target revenue for each type, if any.

- Column 5 indicates the share of revenue for this type of the total amount as a percentage.

- Column 6 should only be completed by non-profit organizations.

After filling out the table, the result is summed up - the total amount of revenue, which will be 100%.

Attention! Based on this data, line 10 records the name and code of the type for which the greatest revenue was received. If two or more species have the same share, then the organization itself can choose which OKVED to indicate.

The certificate is signed by the manager and chief accountant. If there is a seal, you need to put its imprint on the document.

Application form

Based on the certificate, an application to confirm the main type of activity is filled out.

After the name of the document by which the form was put into effect, the date of completion is indicated.

Then you need to indicate the name of the social insurance authority to which the certificate is sent.

After the title of the form, write down the full name of the organization according to the constituent documents, social insurance registration number and subordination code.

Attention! The next field is not checked - it is necessary to indicate the fact that the certificate was submitted by the government agency.

On the form you must indicate the number of sheets of attachments in the application. After this, the manager signs it.

Responsibility for failure to provide a certificate

The law does not define any specific punishment for the fact that a business entity has not sent confirmation of the main type of activity to the Social Insurance Fund.

But if the company does not submit a certificate, then the fund has the right to independently determine the main type of activity for the organization, and on its basis assign a percentage for calculating contributions for injuries. This process occurs according to the following scheme.

The responsible employee of the fund requests an extract from the Unified State Register of Legal Entities for the company, establishes the degree of danger for each type of activity entered there and assigns the highest interest rate corresponding to the most dangerous type.

During this process, the fund will not take into account whether the selected species is currently in use, or whether it was included during registration among others.

Such an action by the FSS previously caused many lawsuits - organizations tried to prove that the fund does not have the right to choose the species on its own. However, since 2017, this action has been enshrined in a Government Decree, and is now carried out legally.

Attention! After the organization has been assigned a percentage rate for injuries, the Social Insurance Fund sends a notification letter by May 1.

Confirmation is necessary even when the entity did not conduct production activities during the previous period. The FSS will then consider this case as a failure to provide data, and therefore will assign a rate according to the algorithm described above. Therefore, even if no activity was carried out, it is better to fill out the form with “zeros” and submit it to the fund with an explanatory note.

An application for confirmation of the main type of economic activity is submitted to the Social Insurance Fund in order to confirm the right of the payer of “unfortunate” contributions to apply a tariff of a certain amount for them. Let's consider the form, procedure and deadlines for submitting this document. We will also tell you what will happen if you do not submit such an application on time.

How are contribution rates and types of activities related?

NOTE! In some cases, policyholders still manage to challenge the maximum tariff.

Forms of documents submitted to the Social Insurance Fund to confirm the activities carried out by the policyholder can be downloaded on our website:

You can also confirm the type of activity viaor.

Deadlines for confirming the main activity in 2019

The company must confirm the type of activity by April 15 of the year following the reporting year (clause 3 of the order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55).

April 15, 2019 - Monday. This means that this year the question of the possibility of postponing the deadline will not arise for policyholders. And yet, just in case, we will tell you whether the confirmation period is postponed if the reporting date falls on a weekend or holiday. Let us remember that this was the case in 2018, when April 15 was a Sunday.

So, there are no clear instructions on when to submit documents if the deadline falls on a non-working day in the order of the Ministry of Health and Social Development dated January 31, 2006 No. 55. Because of this, it happened that territorial social insurance funds required reporting before the weekend. But in 2017, the FSS department issued a letter explaining this issue, according to which the period for confirming the type of activity is extended until the next working day (see FSS letter dated 02/08/2017 No. 02-09-11/16-07-2827). Therefore, in 2018, documents were accepted on Monday, the 16th.

Will there be penalties for late confirmation of the type of activity?

No, there are no penalties for failure to submit a certificate under current legislation. However, as mentioned earlier, the policyholder will pay accident premiums throughout the year at the maximum rate corresponding to the most dangerous class of activity established in his extract from the Unified State Register of Legal Entities.

Results

The rate of insurance premiums for accident insurance depends on the professional risks that are inherent in a particular activity. He is appointed for the activity that is the main one for the policyholder. The policyholder himself annually informs the Social Insurance Fund about which type of activity is his main one by submitting an application and a certificate confirming the predominance of this type of activity based on the figures of the past year.

The obligation of annual confirmation is assigned by Decree of the Government of the Russian Federation of December 1, 2005 No. 713 to policyholders exclusively in the status of a legal entity and their divisions. The main type of activity of individual entrepreneurs is taken by the Federal Social Insurance Fund of the Russian Federation from the Unified State Register of Individual Entrepreneurs and does not require additional approval. Insured against industrial injuries, in accordance with Federal Law No. 125-FZ dated July 24, 1998, include legal entities of any organizational and legal form, including foreign organizations that hire employees under an employment contract, as well as civil and industrial agreements, if they provide for an obligation upon payment of the corresponding insurance premiums.

Why confirm the main type of economic activity

The main type of economic activity of the employer determines the level of occupational injuries, the likelihood of occupational illness and the amount of corresponding insurance costs, which for the purposes of applying Law No. 125-FZ is called the occupational risk class. This indicator directly determines what percentage of the employee’s accrued wages will need to be transferred to the Federal Social Insurance Fund of the Russian Federation as an insurance contribution.

To determine the rate, the classification from the appendix to the Order of the Ministry of Labor of the Russian Federation dated December 30, 2016 No. 851n and the tariffs established by the Federal Law dated December 22, 2005 No. 179-FZ for 2006, but valid to this day, are used. In accordance with these acts, the most harmless Russian enterprises pay contributions in the amount of two-tenths of a percent of an employee’s income, and the most dangerous ones have to pay 8.5 percent.

How to confirm the main type of economic activity

Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55 established the following package of documents that must be submitted to the territorial body of the Social Insurance Fund of the Russian Federation at the place of registration: - application for confirmation of the main type of economic activity;Certificate confirming the main type of economic activity;

A copy of the explanatory note to the balance sheet for the previous year (except for small businesses).

These forms can be submitted either on paper or electronically. A personal account on the government services website is also suitable for this purpose.

If the application and documents are submitted electronically, in accordance with clause 20 of Section II of the Administrative Regulations, approved by Order of the Ministry of Labor of the Russian Federation dated September 6, 2012 No. 178n, they must be signed with an enhanced qualified electronic signature.

It is necessary to wait for the reaction of the fund branch

No later than two weeks later, confirmation of the assigned tariff must be received from the FSS office of the Russian Federation. Until this moment, the policyholder belongs to the category received in the previous year, and after that he can apply the new rate from January 1 of the current year.What should multidisciplinary business owners do?

If you have a diversified business, the proportions of revenue distribution will be decisive. If the shares are equal, you will have to be content with the most expensive of the tariffs, and if not, then the most feasible type of activity will become the calculated type of activity.Deadlines for submitting documents confirming the main type of economic activity

Regarding the deadlines for sending confirmation in 2018, the situation was ambiguous.As a general rule, you need to register no later than April 15, but the nearest date X falls on a Sunday, and no postponement is possible. Therefore, sending the kit later than Friday the 13th will be considered late.

At the same time, the website of the Moscow regional branch of the FSS of the Russian Federation contains information that the deadline for submitting a set of documents is changing and is being postponed to the next working day - April 16.

If the main type of economic activity is not confirmed

If you are late or do not submit the necessary documents at all, the FSS of the Russian Federation, in accordance with clause 13 of Government Decree No. 713 dated 01.12.2005, has the right to classify the policyholder as the highest risk class of activity, based on the OKVED codes indicated in the state register of legal entities. Moreover, you will have to overpay all year.However, some employers whose main activity coefficient does not exceed the most dangerous code in the Unified State Register of Legal Entities do not face tariff-related losses, and in this case no sanctions are provided.

The remaining policyholders who have not confirmed their legal right to lower the rate will receive a “letter of happiness” with the percentage established by the Federal Insurance Service of the Russian Federation by May 1.

Confirmation of the main type of activity in the Social Insurance Fund

In March, accountants submit many different annual reports: balance sheets, certificates, tax returns. The main thing in this hot time — do not miss the deadlines and submit a full set of reports required by each organization. One of these reports is a certificate confirming the main type of economic activity. In this article we will tell you about all the nuances of drawing up and submitting a certificate.

Not all regional offices of the FSS accept this reporting in electronic format. The method of reporting should be clarified with your Fund branch.

How to fill out a confirmation certificate

The confirmation certificate contains the main details of the company: TIN, address, average headcount, company registration data, etc.

Types of activities are recorded in the tabular part of the certificate. Column 3 should indicate the amount of revenue excluding VAT for each type of activity.

In line 10 of the confirmation certificate, the policyholder indicates the full name of the OKVED code for the activity that has the greatest share.

Based on the certificate, an application for confirmation of the main type of activity is drawn up, which indicates one main type. If the policyholder prepares an explanatory note for the annual reporting, it should also be attached to the application.

Example of filling out documents

Stroyka LLC carries out three types of activities: it carries out finishing work (code 43.3), carries out the maintenance and repair of vehicles (code 45.20) and rents out cars (code 77.11).

In 2017, revenue excluding VAT amounted to:

OKVED 43.3 - 250,000 rubles;

OKVED 45.20 - 1,700,000 rubles;

OKVED 77.11 - 1,700,000 rubles.

The company's total revenue was 3,650,000 rubles (250,000 + 1,700,000 + 1,700,000).

As can be seen from the conditions of the problem, LLC “Stroyka” has the same revenue from two types of activities and significantly exceeds revenue from finishing work. If revenue indicators for various types of activities have an equal share, the main type of activity is the one that corresponds to a higher risk class.

Service Expert Standard

Rogacheva E.A.

Every entrepreneur, before starting his business, must decide on the type of OKVED. Only the presence of this code will allow you to obtain a license to operate. Every year, before April 15, it is required to confirm the main type of economic activity of the policyholder by submitting an application to the Social Insurance Fund (SIF). This procedure is simple, but it requires attentiveness and literacy from entrepreneurs and legal entities.

Why is OKVED needed?

OKVED is a special code that designates the type of activity, industry of production or provision of services to citizens of the Russian Federation. Knowing this code, a tax officer can accurately determine the tax rate. There is a detailed OKVED classifier, it was created to simplify the preparation of documents during registration.

There are 17 sections, which in turn are divided into subsections to more accurately determine the type of activity of an individual entrepreneur and a legal entity. The OKVED code can include from 2 to 6 characters:

- The first 2 digits are the class;

- 3rd – subclass;

- 4th – group;

- 5th – subgroup;

- 6th – view.

In the OKVED list you can find any type of activity that is permitted in the Russian Federation.

The annual OKVED confirmation allows the FSS to calculate the correct insurance rate for the applicant. If you do not update the data, then the FSS independently determines this tariff; usually the maximum rate for your type of activity is applied.

What documentation is needed?

To confirm the type of economic activity, you must provide the following documents:

- a statement in electronic or paper form confirming the main type of economic activity. It is submitted to the Social Insurance Fund at the place of registration;

- a certificate confirming the main type of economic activity indicating the profit for each type separately, in ruble and percentage equivalent;

- all legal entities, excluding small businesses (SMB), provide in any form a copy of the explanatory note to the balance sheet for the past year.

Check out also: Payment for housing and communal services through State Services

Blank form templates and examples of how to fill them out can be downloaded from the FSS and State Services website.

Sample of filling out an OKVED confirmation application

A sample of filling out an application for confirmation of OKVED can be found on the FSS website and on the State Services portal. It takes up one A4 page, form P24001.

The following fields must be completed in the application:

- the name of the territorial body of the Social Insurance Fund where the application is submitted;

- the name of the applicant organization, as indicated in the constituent documents;

- registration number;

- subordination code;

- year of OKVED confirmation;

- type of economic activity;

- OKVED code;

- number of sheets in the application;

- signature of the head of the organization.

How to confirm OKVED through State Services

In order not to contact the FSS personally, an entrepreneur or the head of an organization can submit an application for confirmation of OKVED through the State Services portal. The procedure is absolutely free and will take no more than 15 minutes to complete.

Go to the official website of the portal gosuslugi.ru and go through a simple registration procedure. To open a personal account for an organization, its representative, an individual, must first register, indicating his full name, contact phone number and email. Then you need to confirm your identity:

- using an enhanced qualified electronic signature or UEC;

- at the customer service center;

- by sending a confirmation code request by mail.

Only after your identity has been confirmed can you create an account for a company or businessman.

After logging into your personal account, select the “For Legal Entities” section in the service catalog. In the “Labor and Professional Activities” section, select the “Confirmation of the type of activity in the Social Insurance Fund” tab. Here you download the application and confirmation certificate templates and fill out all the required fields. Attach all completed documents as files with the extension .pdf or .tif. If you are an SME, then instead of an explanatory note to the balance sheet, indicate information about its absence.