In what assessment are MPs taken into account? Accounting for inventories (MPI)

They are part of the company's assets. They are used as raw materials or production materials for the manufacture of products, are intended for sale and can be used for their own needs.

According to accounting regulations No. 5/01, production and material inventories also include various goods and products ready for sale. Industrial inventory items are divided into various groups depending on their purpose. This is the main group of production inventories used in the process of creating products (raw materials, semi-finished products and components) and an auxiliary group that serves to maintain the means of labor in good condition (varnishes, paints, fuels and lubricants).

Accounting for inventories is carried out on accounting accounts No. 10 “Materials”, No. 12, No. 15 “Procurement and purchase of goods and materials”, No. 16 “Deviations in the cost of goods and materials”.

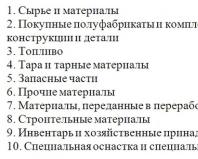

Depending on their technical properties, production ones are divided into separate subaccounts. These are the following accounting sub-accounts - “raw materials and materials”, “purchased components and semi-finished products”, “fuel”, “containers and materials”, “spare parts”, “other materials”, “construction materials”, “inventories transferred for processing”, "household equipment".

The assessment of inventories in accounting when they arrive at the warehouse is carried out at their actual cost. Is the total cost of inventory items formed from the actual cost indicated in the receiving documents (incoming invoice)? and additional costs associated with their purchase (information services, transportation costs, insurance and others).

Accounting for inventories at any business entity is carried out only on the basis of the primary basis. The basis for accepting production inventories for accounting is the transport invoice, incoming invoice from the seller, which includes quantity, unit price and total cost including VAT. Next, the receipt is registered. Inventory received from production shops is transferred to the warehouse on the basis of an internal invoice.

Accounting for inventories requires a mandatory inventory, carried out at least once or twice a year to confirm the actual balances in the warehouse. Mandatory inventory and actual assessment of the technical condition of inventories is carried out at the end of the year or can additionally be carried out when changing the chief accountant or director of the enterprise, those officials who are directly responsible for the availability of inventories, for their correct reflection in accounting. The inventory of production inventories is carried out by a special commission created at the enterprise to inspect material warehouses and carried out at the enterprise with the personal participation of storekeepers and representatives of the commission appointed by order.

Analytical accounting of inventories is carried out for individual warehouses in the context of subaccounts and individual groups of inventory items. Analytical accounting depends on the chosen method for valuing inventories (for example, based on the average price method).

Accounting for inventories in the financial statements necessarily contains information about the methods of accounting for inventories used at the enterprise in accordance with the approved accounting policies. Properly organized accounting of inventory items is the most important factor for the uninterrupted organization of the production process and product output. Also, the accounting statements must highlight the types and value of inventory items transferred as collateral to another enterprise.

Every company must own current assets that provide it with stable production and financial condition. One of the main parts of current assets are inventories (MPI).

They include raw materials necessary for production or for the provision of services (works), assets necessary for management to perform their functions, as well as goods intended for sale, if it is a trading organization. In addition, these are tools, spare parts for equipment, fuel, protective equipment, special clothing and even fixed assets that cost less than 40 thousand rubles.

Inventory accounting has its own range of tasks, which are determined by current legislation. Namely:

- determining the size that affects the cost of inventories;

- correct execution of documentation for the submission at the right time of information on produced, received and sold inventories;

- ensuring the safety of reserves during their storage and operation;

- ensuring continuity of the production process through timely replenishment of stocks;

- analysis of the quantity and structure of inventories in order to identify unclaimed materials or their surplus;

- implementation of activities aimed at analyzing the effectiveness of their use.

The main regulatory document, of course, should be called Federal Law No. 402-FZ. However, it only contains general accounting requirements.

When reflecting inventory, it is necessary to be guided by accounting provisions, namely:

- PBU 5/01. This document reveals the concept of inventories, their composition, reveals the essence of the various methods of their evaluation that an enterprise can use, as well as the rules for their reflection in accounting;

- PBU 9/99 – used when calculating the financial result from the sale of goods and manufactured products;

- PBU 10/99 – applies if there has been a disposal of inventories;

- – necessary when drawing up the company’s accounting policy, which should also reflect the valuation methods used, the accounting accounts used, and the rules for conducting inventory.

Also included in the regulatory framework is the chart of accounts along with instructions and corresponding methodological recommendations from the financial department of our country.

Classification in accordance with PBU

PBU 5/01 divides the assets under consideration into following categories:

- raw materials, i.e. assets that are used as input materials for the company's main production;

- assets that were purchased or manufactured for sale. This refers to goods and finished products;

- inventories necessary for the functioning of the company.

Guidelines for accounting

Inventory materials are objects that a person influences in order to obtain finished products, and ultimately, profit. It is necessary to understand that they are completely consumed during the production process, in contrast to the means of labor, i.e. fixed assets, the costs of which are included in the cost of production in parts through the mechanism.

Price

The cost of inventories in accounting is determined based on the actual costs incurred for their acquisition or creation. If the inventory was purchased under a sales contract with a counterparty of the company, then their cost includes:

- amounts paid under this agreement;

- advisory costs associated with the transaction;

- amounts paid to intermediaries with their participation;

- customs payments;

- fare;

- taxes that are not refundable.

This list is not closed. The law requires that all costs associated with their acquisition be included in the cost of inventories.

This list is not closed. The law requires that all costs associated with their acquisition be included in the cost of inventories.

If MPZ is a product of the company’s own production, then their cost includes all costs incurred in the process of their production.

The assets in question may come to the organization in other ways. For example, they were provided by the founder. In this case, he himself determines their value, having previously agreed on it with the other owners of the company.

If the assets were received free of charge, then the market price of similar objects is taken as the basis.

Inventory cost consists of actual costs expenses incurred in acquiring them. However, the law does not allow it to be changed. However, there is an exception to this rule. So, if MPZ are outdated or have to some extent lost their useful properties, then they must be reflected in the reporting at the price at which they can actually be sold. And the resulting difference accordingly reduces the company’s current profit.

For this purpose, the PBU allows create an appropriate reserve. This provision must be enshrined in the company's accounting policies. According to the current rules, the reserve is formed once at the end of the reporting year.

For this purpose, the PBU allows create an appropriate reserve. This provision must be enshrined in the company's accounting policies. According to the current rules, the reserve is formed once at the end of the reporting year.

However, its amount cannot be arbitrary. It is calculated as the difference between current market prices for assets and their value in accounting. It will not be superfluous to prepare documents indicating the level of market prices.

The Chart of Accounts for accounting for reserves for reducing the value of inventories provides count 14. This account is not reflected in the final statements, therefore the balance sheet shows the cost of inventories minus the reserve.

Disposal

Disposal of inventories usually occurs by transferring them to production, for the needs of management and maintenance of core activities. Also, these assets can be sold, transferred as a contribution to another company or to ensure joint activities.

All of the above actions must be accompanied by correctly completed documentation. For example, the release of materials into production occurs on the basis of requirements, limit cards or invoices for internal movement.

The implementation is accompanied invoices And invoices. All these documents have a unified form, but its use is currently not the responsibility of the company. Companies can determine their own document formats. The only condition that must be met is the presence of the mandatory details contained in Federal Law No. 402-FZ.

Reflection on the balance sheet accounts

In the balance sheet, inventories are reflected in the second section, because They refer to current assets that are used by the company throughout the year. For them, a generalized line 210 “Inventories”, which is then deciphered on separate lines, where materials and raw materials, goods and finished products, as well as unfinished production are indicated separately.

In the balance sheet, inventories are reflected in the second section, because They refer to current assets that are used by the company throughout the year. For them, a generalized line 210 “Inventories”, which is then deciphered on separate lines, where materials and raw materials, goods and finished products, as well as unfinished production are indicated separately.

Separately, it should be recalled that the balance according to Russian legislation must be recorded in net valuation. That is, it must reflect the real value of inventories.

So, if the company created a reserve, then it is deducted from the value of the assets. And if the organization’s accounting policy provides for the reflection of deviations in the cost of materials on a separate account, then the cost of materials should be indicated minus such deviations.

Accounting for inventories in a company should be organized in such a way that interested parties can quickly obtain information about the composition of inventories, their cost, availability and movement. As a rule, these assets are stored in warehouses, so it is warehouse employees who must provide analytical accounting. Accounting employees should be controlled identity of warehouse and accounting records of inventories, which must be maintained in parallel.

Financial legislation in inventory accounting provides companies with a fairly wide choice.

Financial legislation in inventory accounting provides companies with a fairly wide choice.

For example, they may record purchased materials at actual cost or use accounting, while using an invoice to reflect any variances that occur. They can decide for themselves whether an impairment reserve is needed or not, and how often they will conduct it.

Also, companies themselves can determine how accounting and warehouse records are maintained. So, in a warehouse you can account for assets in physical terms, and in accounting - in monetary terms.

The main thing that all the nuances were reflected in the company’s accounting policies. It is this document that serves as the starting point for inspections by various regulatory authorities. Based on it, inspectors draw conclusions about how the accounting of the inventories and its documentation is organized.

Off-balance sheet accounting

The organization's balance sheet should reflect those values that are in its possession, but do not actually belong to it. In the chart of accounts there are the following, on which inventory is recorded:

- 002 – materials that do not belong to the company by right of ownership are reflected here. These may be assets received by mistake, assets in temporary storage, defects, etc.

- 003 – the so-called, i.e. assets that were received by the company for the purpose of further processing and which are subject to return to the transferring party.

- 004 – consignment goods that the organization accepted for sale as an intermediary.

- 006 – strict reporting forms. Used by companies that do not use cash registers.

Forms of primary documentation

Every accounting entry must be made based on document.

Every accounting entry must be made based on document.

If the inventories were purchased from a counterparty, then their purchase was made on the basis of a power of attorney issued to an employee of the company.

A receipt order must be issued at the warehouse, the basis for which is the delivery of supplies along with the delivery note, invoice and TTN.

Movement within the company is accompanied by the following documents:

- limit-fence cards;

- requirements;

- invoices for internal movement;

- acts on the receipt of materials received during the dismantling of property, etc.

If the sale of goods and materials took place, then invoices and TTN must be issued.

All listed documents have approved form, but their use is not required.

Assessment methods

When disposal of inventories, they also need to be assessed. PBU 5/01 allows the use one of the following methods:

- by the value of each asset;

- at average cost;

- at the cost of the earliest acquired asset ();

- at the cost of the last acquired asset (LIFO).

The method used must be specified in the company's accounting policy.

First method assessments can be used by companies that produce products with a small range, i.e. list. In such a situation, she can easily track the movement of materials and accurately account for the spent asset in the cost of goods.

First method assessments can be used by companies that produce products with a small range, i.e. list. In such a situation, she can easily track the movement of materials and accurately account for the spent asset in the cost of goods.

At second method all stocks are divided into homogeneous groups. And for each group its own average cost is calculated by dividing the total cost of the group by the number of assets included in it.

At third And fourth methods estimates, it is considered that the first or last received stocks are released into production first, respectively.

Postings

For accounting of raw materials and materials used accounts, 15, 16, 14. The table shows the main typical wiring.

| Contents of a business transaction | Corresponding accounts | |

|---|---|---|

| Dt | CT | |

| Inventory received from suppliers, accountable persons and other creditors | ||

| Actual cost | 10 | 60, 71, 76 |

| VAT included | 19 | 60, 71, 76 |

| Actual cost | 15 | 60, 71, 76 |

| Accounting estimate | 10 | 15 |

| VAT included | 19 | 60, 71, 76 |

| Supplier invoices paid | 60 | 51 |

| VAT is deductible | 68 | 19 |

| Accounting is carried out at actual cost | ||

| Materials released from warehouse | 20, 23, 25, 26, 28, 44 | 10 |

| Accounting is carried out using account 15 | ||

| Accounting valuation materials released | 20, 23, 25, 26, 28, 44 | 10 |

| Deviations of actual cost written off: | ||

| the actual cost exceeded the accounting cost | 16 | 15 |

| the actual cost did not exceed the accounting cost | 15 | 16 |

| Materials have been shipped to customers | 62, 76 | 91 |

| Payment received from buyer | 51 | 62, 76 |

| The actual cost of sold inventories was written off | 91 | 10 |

| The accounting valuation of sold inventories was written off | 91 | 10 |

| Deviations of the actual cost of inventories from the accounting ones were written off | 91 | 16 |

| VAT accrued on sold inventories | 91 | 68 |

| Transferred to MPZ as a financial investment in the authorized capital | 91 | 10 |

| 58 | 91 | |

| MPZ transferred free of charge | 91 | 10 |

| A reserve has been formed | 91 | 14 |

Inventory

Legislation obliges companies at least once a year carry out an inventory of inventories. An extraordinary one is carried out if a warehouse employee quits, if the property is sold or rented, if theft or fraud has been revealed, etc.

During the inventory, a comparison is made between accounting data and the actual availability of inventories. The inspection must be carried out by a commission that signs the relevant act. This act with the result of the inspection is approved by the head of the company.

Identified surplus inventories are reflected in accounting as income of the organization and are credited to the warehouse. Deficiencies are initially attributed to, and then compensated by the person at fault. If this employee has not been identified, then it is included in other expenses of the company. In case of natural disasters, it is immediately taken into account as a loss.

A webinar on the new inventory accounting procedure is presented below.

Inventory inventories (MPI) are part of the property that is responsible for the production of various products, provision of services, and is also used in the management activities of an enterprise or organization.

Classification of MPZ

According to accounting regulation No. 5/01, inventories are divided into the following groups:

- raw and basic materials. This group includes production facilities that are responsible for the manufacture of goods or form its basis;

- auxiliary materials that act on raw materials to improve the consumer qualities of the product, or to maintain the technical equipment of the enterprise;

- purchased semi-finished products. In this case, they are a kind of procurement raw materials, the processing of which produces finished products;

- recurrent balances of the enterprise. This is waste materials resulting from the production of a finished product. Many enterprises incidentally produce various consumer goods from such residues;

- fuels and lubricants. Which, in turn, are classified according to their purpose into: household (for heating the premises), motor (for refueling automobile and agricultural vehicles) and technical (for servicing various mechanisms);

- packaging materials. Used for packaging, transportation and preservation of manufactured goods;

components for various equipment used and specialized equipment that are used to replace failed parts.

The main tasks that the accounting of material industrial inventories involves are as follows:

- constant supervision of the entire production cycle;

- control over product storage;

- correct execution of the necessary documentation;

- accurate determination of the cost of finished products;

- control over surpluses or shortages of a certain group of inventories;

- compliance with all standards provided for by state legislative acts.

This systematization allows for accounting reporting of income, expenses and balances of material assets in a particular organization.

Analysis of inventories

Inventory and equipment are taken into account at their actual cost. Which is the amount of money spent by the enterprise on the purchase of necessary production materials.

In addition, actual expenses can be incurred for the following purposes:

- payment of funds in accordance with the agreement concluded between the organization and the supplier;

- payment for all kinds of services provided and necessary information provided to the enterprise;

- payment of customs taxes;

- payment of non-refundable fees;

- various incentives that are paid by the brokerage institution through which tangible production assets were obtained;

- expenses incurred as a result of the preparation and transportation of the necessary production products;

- payment for insurance of purchased inventories.

Actual expenses cannot include costs incurred when purchasing general business material assets. The real initial cost of inventories when produced directly by the enterprise is formulated by the costs associated with the production of these reserves.

If the real cost is obtained by introducing values into the authorized capital of the enterprise, then it is determined using a financial analysis carried out and agreed upon by the participants of this organization.

Inventories can be assessed in one of the following ways:

- at the average initial cost;

- at the original cost of each product separately;

- FIFO (at cost of the 1st according to the procurement period;

- LIFO (at cost of subsequent purchases according to the purchase period).

The first method of analyzing inventories is the most popular among accounting workers of organizations located in the Russian Federation.

Documentary formation of operations for moving inventories

All economic procedures must be carried out with the help of supporting documentation. This package of documents consists of primary accounting acts, which are primarily intended for accounting at the legislative level.

Basic documentation on the movement of inventories must be drawn up under the clear guidance of the first manager and chief accountant of the enterprise, who are responsible to the regulatory authorities for the correctness of their preparation.

If production assets come from manufacturers, then the warehouse manager is obliged to check the received goods for compliance with the accompanying documents of the supplier. If there are no disagreements, on the same day the warehouse manager must draw up a single copy of an act (receipt order in form No. M-I) for all goods received. If the delivered products do not coincide with the documents provided for them, the storekeeper, together with the authorized person of the supplier, draws up a report in form No. M-71 in two samples.

Also, receipt acts are drawn up when inventories are received by an enterprise from an individual working in this organization. Such valuables are mainly purchased in cash at retail outlets. Such purchases must also be confirmed by supporting documents (checks, certificates, acts).

Acts in form M-11 are issued if inventories are moved within the organization (from one site to another or from a warehouse to a workshop). In such cases, the order to issue invoices must come from supply workers.

Inventory accounting

The movement and balance of material assets is subject to mandatory accounting at the enterprise. Which is carried out by warehouse and accounting department employees.

These responsible persons, in order to legally correctly maintain records of existing valuables, must perform the following actions:

- Accounting employees open warehouse cards;

- after which information about the material located is entered into the card;

- the completed card is transferred from the accounting department to the warehouse;

- The warehouse manager records entries in the prepared cards about receipts, expenses and balances of material assets;

- At the same time as the cards, the storekeeper fills out the sort accounting book.

All basic documentation for inventory accounting comes from all departments and workshops of the enterprise to the accounting department. Where, after a scrupulous check, all received accounting documents are sent to a computer.

There are two options for accounting for inventories using cards, which record all accounting transactions based on primary documents: in the first case, the accounting department creates

- card exclusively for a specific variety and type of incoming products. These cards keep records both in kind and in monetary terms. After the expiration of the monthly period, such cards must be verified and correspond to the accounting cards in the warehouse;

- in the second case, all negotiable documents are added according to assortment numbers. At the end of the reporting period, the final figures are calculated and subsequently entered into the statements.

Which option is more convenient is determined by each company independently. The only important thing remains a true reflection of the financial activities of the enterprise.

What is it and who should do it at the enterprise? Read about this in our material.

Synthetic or generalized accounting of inventories

Synthetic accounts that are used to account for material inventories:

- 004 – products accepted for commission;

- 003 – MPZ taken for processing;

- 002 – MPZ accepted for storage;

- 16 – discrepancy in inventory value;

- 15 – purchase of necessary materials;

- 14 – revaluation of values;

- 11 – agricultural animals being fattened;

- 10 – materials.

To keep records of purchases or procurement of material and production assets in accounting, two types of accounting are used:

- the first type implies the reflection of incoming materials according to the debit “10 – materials” and credit accounts “60 – financial payments to contractors and suppliers”, “76 – repayment of credit debt”. Thus, inventories are taken into receipts regardless of the receipt of settlement documentation. And at the beginning of the reporting month, unpaid financial resources will be taken into account as a receivable debt to contractors or suppliers;

- the second type determines the use of additional synthetic accounts: “15 – purchase of necessary materials” and “16 – discrepancy in the cost of inventories”.

Inventory of material assets of the enterprise

Regulatory legal acts in force in the country provide for a mandatory inventory of property. Which is carried out for the truthfulness and literacy of accounting.

During the inventory, special attention is paid to the presence and condition of inventories, which must be confirmed by relevant documents.

The legislation provides that the period for conducting the inventory can be determined personally by the head of the enterprise, except if:

- the property changes owner;

- annual reporting is prepared;

- there are facts of damage or theft of property;

- there are force majeure circumstances provided for by legislative acts.

If the inventory carried out showed a shortage of material assets, then the responsibility lies with the official exercising control over the correctness of accounting of the enterprise's inventories.

In contact with

Material production reserves of the enterprise– these are current assets involved in the production and management cycle. In other words, this is property used for the production of finished products.

Accounting for inventories PBU 5/01. Position

The regulation on accounting for inventories was approved by order of the Ministry of Finance of the Russian Federation (No. 44n dated June 9, 2001). This provision establishes the accounting principles (PBU 5/01) of inventories at the enterprise.

Classification of an enterprise's inventories

Inventories include the following types of enterprise assets:

- raw materials and supplies used in production;

- goods intended for sale, provision of services or involved in management needs;

- finished products that have gone through the entire production cycle;

- goods purchased from other organizations (legal entities).

It should be noted that the provisions of PBU 5/01 do not apply to accounting for work in progress.

Unit of accounting for inventories is installed individually at each enterprise. The purpose of accounting is the most reliable reflection of information about the state of the enterprise's inventories and control over their movement (acquisition/disposal).

Unit of accounting for inventories

Valuation of inventories

Material production inventories (MPI) must be accounted for at their actual cost.

Actual cost of inventories for the purchase of inventories– the amount of expenses of the enterprise for the purchase of goods and materials excluding VAT, customs duties and fees, excise taxes on certain types of goods/services. Accounting takes into account the following types of costs for the acquisition of inventories.

It should be noted that when calculating the actual costs of purchasing inventories, general business costs are not taken into account.

The actual cost of inventories during production is the amount of expenses an enterprise costs in the production of goods and materials.

The actual cost of inventories contributed to the authorized capital is determined based on the assessment by the owners of the enterprise.

The actual cost of inventories upon donation is estimated based on the market value as of the accounting date.

The actual cost of inventories under non-cash payment agreements is an assessment of the value of transferred assets at prices of similar types of assets.

The actual cost of acquired foreign inventories is determined based on their value at the exchange rate of the Central Bank of the Russian Federation as of the date of accounting for inventories.

Methods for assessing inventories according to PBU 5/01

The following valuation methods are used to account for inventories:

- at the weighted average price per unit of material;

- at the cost of each unit;

- FIFO method (at the cost of the first purchases);

MPZ - some part of the property a, which is used:

- in the production of all types of products, when providing various services and performing work, intended for further implementation;

- For management basic needs of the company.

Production materials include precisely those assets whose service life is less than a year.

Current assets:

- Finished products– this is the final main result of the production process, processed, endowed with quality and technical characteristics that meet the terms of the contract and intended for further sale.

- Materials– MPZ, completely and completely consumed during production, completely transferring their cost to the cost of services, work, and finished products.

- Goods – inventories purchased from other companies or individuals for further sale.

News inventory accounting is necessary for:

- systematic control over the integrity of material assets in places where they are stored throughout the entire production process;

- timely reflection of transactions in the enterprise’s financial statements, directly related to the movement of certain material assets, detection and reflection of costs directly related to their production, determining the actual cost of materials used and balances in storage areas and balance sheet items;

- constant monitoring of compliance with the stock standards established at a particular enterprise;

- making necessary payments to suppliers, full control over materials that are still in transit.

When maintaining records, it is extremely important that documents are kept in order. TO You can learn how to staple documents correctly from this.

How is this stock classified?

By type of property:

- valuable assets, privately owned enterprises;

- valuable assets, stored in the organization, but not owned by it, taken into account on the balance sheet.

Depending on the space they occupy in the production process:

- auxiliary materials;

- fuel;

- various materials and raw materials;

- container;

- spare parts;

- purchased various semi-finished products.

In order of application:

- valuable assets, involved in production;

- valuable assets intended for sale ( goods, finished products);

- valuable assets as means of labor.

Inventory in accounting is assessed based on actual cost.

Actual cost is determined by summing two elements:

- cost, for which the inventories were purchased;

- procurement costs and transportation (TZR).

TZR includes transportation costs, delivery of materials to the storage location, interest payments to suppliers for commercial loans and fees to company intermediaries.

Real the cost depends on how the materials received by the organization.

Are you thinking about how to set up a business? Read the link.

Receipt of supplies

- Purchase under a purchase/sale agreement. With this option, the cost includes the technical requirements and the cost according to the contract.

- Contribution to the authorized capital of the company. In this case the cost of inventories is determined by the founders of the enterprise.

- Transfer to free use.

Objective cost is determined according to market prices on the date of receipt of assets.

- Manufacturing in-house. Objective cost in this case is calculated by summing up all expenses spent in the production process.

The actual cost does not include VAT.

MPZ: accounting on the enterprise balance sheet accounts

To account for inventories synthetic accounts are used, such as:

- Materials – 10 and subaccounts;

- Fattening animals – 11;

- Acquisition of assets and their procurement – 15;

- Deviations in asset values – 16;

- Products – 41;

- Finished products – 43.

Accounts on balance:

- MPZ, accepted for storage – 002;

- Materials for processing – 003;

- Goods on commission – 004.

When any company enters the market, a trademark is very important. How to register a trademark - read.

Types of primary reporting

Inventory accounting is carried out on the basis of primary documentation, which includes:

- powers of attorney;

- receipt orders;

- acceptance certificates;

- requirements;

- invoices for intra-enterprise movements and vacations;

- accounting cards in stock;

- accounting statements.

Acceptance of inventories onto the balance sheet of the enterprise

PBU 5/01 – inventories are always credited to the enterprise’s balance sheet at actual cost.

The objective cost of inventories purchased for money is the amount of the enterprise's actual expenses for the acquisition, excluding VAT and other taxes.

Actual expenses for the purchase of inventories may be:

- amounts paid under the agreement to supply;

- expenses, directed to pay for consulting and necessary information services, related to the purchase of inventories;

- customs contributions and other payments;

- non-refundable taxes paid in connection with the purchase of a unit MPZ;

- intermediary fees;

- costs for timely procurement and reliable delivery supplies to the place of their use, as well as insurance;

- other costs related to the purchase of inventories.

How are inventories reflected in the company's balance sheet?

When a transaction is made, information about production fixed inventories(balance of assets at the end of the reporting period) in the organization’s balance sheet are reflected in the corresponding article - Reserves.

Example of accounting entries

The materials arrived at the enterprise warehouse from the supplier company:

By debit – 10, by Credit – 60, amount 200,000

For Debit – 19, for Credit – 60, amount 36.00

The costs of the transport company were taken into account for the transportation of production materials.

For Debit – 10, for Credit – 60, amount 4,000

From current account paid suppliers for materials.

For Debit – 60, for Credit – 51, amount 236,000

Cost of material – 204,000 ( We take into account Materials – 10).

Materials – 10 Active account. According to D – receipt of materials. According to K - their writing.

Proper accounting of inventories will allow you to control the company’s expenses associated with their acquisition, as well as settlements with suppliers and intermediary organizations.

Timely identification of shortages or overspending - the key to a successful business.

There are many things you need to know when preparing accounting reports. To find out what primary documentation is in accounting, click on.

To learn more about inventory accounting, watch the webinar recording: