Blog › For everyone who wants to buy a new car! How to beat prices at car dealerships. Medical uses of Cu. Receipt for the purchase of residential premises at an undervalued or inflated price

Good day everyone!

I’ll tell you about my new experience in buying a new car at the dealership. Thanks friend...

If bargaining when buying a used car does not raise any questions for anyone and absolutely everyone bargains, then when buying a new car at car dealerships, as a rule, if they try to reduce the price, then it is very modestly and not persistently:

- Is it cheaper?

- It can’t be cheaper! And so this price is already at a discount of 200 thousand, and you still want...

It seems that when buying a new car at a price of 1-1.5 million, additionally demanding a discount of 30-50 or 100 thousand is not respectable...

But if they are offered to you, who will refuse them?

So.

Preface.

Having mentioned to a friend that I wanted to sell my one-year-old HYUNDAY Solaris and buy a new AUDI Q3 car and had already decided on both the car and the interior, he asked:

- Did you try to bring down the price?

- Yes, but they didn’t discount anything - and so it’s the end of the year, and so there are discounts on them, etc. and so on.

- Yes, this is not the way to beat prices out of salons! I worked there for 5 years and I can say that at the end of the year, almost all salons do not fulfill the sales plan. And with the right approach, you can bend them by another 50-100 thousand.

In general, listen...

Below I present my steps step by step.

1. I arrived at the salon on the V. highway, where I decided on a car. I asked to look at the equipment of the selected car again and print it out with the price - 1,350,000 rubles. and put it neatly in his bag.

Me: - Thank you. Goodbye!

The manager was somehow puzzled: - Have you made a decision to buy? Or will you think again?

Me: - I’ve made the decision to buy, but I’m not happy with your price. Now I’m going to the salon on L. Highway, they promised to sell it cheaper...

With these words, I left the manager, who, as soon as I began to leave, quickly rushed to his boss.

BECAUSE SIMPLE MANAGERS ARE NOT GIVEN THE AUTHORITY TO PROVIDE DISCOUNTS!

AND HE MUST COORDINATE ANY UNAUTHORIZED ACTION WITH HIS SUPERVISOR.

2. Arriving at the salon on L. Highway, I found out that they had an AUDI Q3 in the configuration I needed or a similar one. Found a similar one. With sports steering wheel and seats. Price 1,410,000 rub. We print out the package and price.

I take out my printout from the salon with V. Shosse, where, allegedly by the manager, the price of 1,350,000 rubles is crossed out with a pen. and the price is written 1,300,000 rubles. and after comparing them, I hand the manager their competitor’s offer.

The manager takes the printout and studies it carefully. Asks when are you ready to buy a car? And he goes off to his boss.

About ten minutes later he comes out with an offer on his printout - 1,320,000 rubles.

- Unfortunately, this is the most low price that we can offer.

- Thank you, I’ll think about it and call.

As I leave, I notice the full weight of responsibility on the shoulders of ordinary managers in fulfilling sales plans.

It’s the end of the year, there’s a crisis in the country, car dealerships are filled with cars that buyers don’t need as much as sellers...

3. The third salon is next to the D. highway.

- What configurations of the AUDI Q3 are available? Can I see this set? (in my opinion, the same as on V. Highway) How much does it cost? RUB 1,370,000? Please print...

In front of the manager, I take two printouts out of my bag and, placing them next to me, carefully study the three options. I don’t look up at the manager, although I physically feel his anxiety and nervousness... (oh, this crisis, oh, this plan...).

- Look! For the same equipment as yours, your friends from V. Highway give 1,300,000 rubles. For an additional sports steering wheel and sports seats, friends from L. Highway give 1,320,000 rubles. In principle, I don’t need them. I am a real buyer who is ready to buy this car now. What can you offer?

The manager takes three printouts and goes to his boss.

Five minutes…

Ten minutes…

FIFTEEN MINUTES…

The two of them go!

- Good afternoon! (Says hello to the boss) When are you ready to buy a car?

- As soon as I decide on the price...

- The maximum we can give for an AUDI Q3 in this configuration is RUB 1,290,000.

- I left a deposit of 10,000 rubles. in the showroom on V. Highway... Because of this amount, I will not waste my time and nerves on returning the deposit... It’s easier for me to buy from them...

Minute pause...

Chief: - Okay! 1,280,000 rub. Are you ready to sign the contract now?

Me: - Yes! (Y-E-E-E-E-E-E-S-SSS!) Where is your credit department? (I decided to take out a car loan).

Two days of travel (although it was possible to travel around everyone in a day). And saved 70,000 rubles!

Yes, that's not all!

When I came to sign the loan agreement, it turned out that the bank, without my knowledge, changed the loan term - from 36 months. Up to 48! My outrage knew no bounds! I (in all seriousness) wanted to send both the bank and the car dealership itself!

The excited manager, also worried about the failure of the deal, offered me free maintenance for 10,000 km (about 14,000 rubles) and mats as a gift.

After thinking, I signed the loan agreement. I bought a car at a price of RUR 1,280,000. with free maintenance and mats.

In order not to take out an additional 12 months of credit, I deposited about 70,000 rubles the next day. with a reduction in the loan term to 36 months.

Summary:

1. Car dealerships do not make money on car sales! They earn bonuses for fulfilling sales plans and providing additional services! Therefore, they can almost always reduce the price!

2. The more salons you visit, the more favorable the offer you can get for yourself.

3. When buying a car (ESPECIALLY ON THE DAY OF ISSUE), do not walk around the car dealership and in front of the manager with a smile on your face! Walk around irritated, sullen - show your dissatisfaction and not wanting to buy this car, find fault with everything - you burned yourself with coffee, you wait a long time, the toilet does not work, etc. Let them soften your mood with gifts (tires, mats, maintenance, etc.).

4. If you want to buy a car using the trade-in system! Your old car - additional tool to receive a discount. They will buy it at trade-in for 5-10 thousand rubles more. if you buy a new car from them.

Look like that's it!

If anyone has any questions, write!

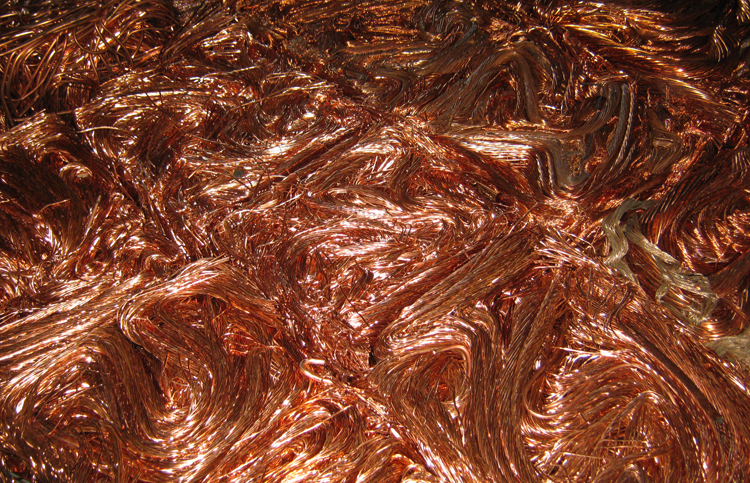

The cost of copper at collection points is regulated by certain standards, which are established based on the results of exchange trading. Some fluctuations up or down are allowed. The cost of a ton of copper on the exchange is currently about $5,846, a dollar is 63 rubles.

That means one kg. copper costs approximately 368 rubles. But we must take into account that first-grade copper is traded on the exchange. And at specialized points they accept copper scrap different varieties, sizes, in the form of alloys, etc.

For one kilogram of copper scrap in our country they give from 200 to 320r. In the regions, these limits may expand or contract, but only slightly + - 5-7%.

Copper prices at collection points depend on quality characteristics metal, type and size of fragments. The quality of copper is determined using special testing equipment, which must be available at every non-ferrous metal receiving point.

What quality copper should be like?

- The metal surface should not be oxidized.

- Traces of soldering, paint and oil are excluded.

- The copper should be smooth, shiny, golden pink or reddish yellow in color.

Where does scrap copper come from?

This metal is found in any electrical engineering, refrigeration or heating equipment, air conditioning systems, cables, electrical wiring, pipes, etc.

What factors influence the cost of one kg of copper at collection points?

The price of one kg of copper depends on the type of metal scrap. According to existing standards each grade must contain a certain percentage of copper and impurities:

- 1st grade - 99%.

- 2nd grade - 95%.

- 3rd grade - 80%.

- Grade 4 - copper-bearing slag, copper-graphite dust, etc.

The next factor influencing the cost of copper scrap is the size of the fragments. Copper comes in the form of shavings, stripped wires (thermal and mechanically cleaned), pieces, bags, etc. Each variety has a specific price. Here is an example of how the size of copper scrap affects its cost in Moscow:

- Copper shine - 303 rub.

- Copper shavings - 235 rub.

- Copper cable - 300 rub.

- Copper mix - 290 rub.

- Copper piece - 293 rub.

Virtual and printed notice boards are full of very tempting offers calling for the sale of scrap copper to favorable conditions. Sometimes they promise big money for one kilogram. Unfortunately, quite often behind such announcements there are gray market players hiding, cooperation with which entails high financial risks.

They may promise you mountains of gold, and subsequently find thousands of reasons to reduce the price or not pay at all. Therefore, it is better to deal with a trusted company that has an excellent reputation and long history. Companies that, despite fierce competition in the market for secondary copper raw materials, have not given up their positions, deserve universal respect. Such companies value their image, which is already a guarantee of timely payment and a fair transaction.

World copper prices have a steady upward trend. This means that at copper collection points the cost is per 1 kg. of metal delivered will steadily increase. Therefore, selling copper scrap is a very profitable business. There is a whole category of citizens for whom such a process is the main source of income and organizations that make a good profit from the delivery of copper from the described equipment.

The purchase and sale agreement is complex. legal document, to the parties in the process of its registration it is important to comply with applicable laws, take special care in drawing up the basic terms and conditions dedicated, for example, to the listing of a property.

How is the price of an apartment purchase and sale agreement determined?

In the process of buying and selling a property, the main importance is determining the cost of housing. The price of the property is essential condition of the contract and must be spelled out in it, otherwise, the document will be considered not concluded at all, even if all other conditions of the written agreement are met (Article 555 of the Civil Code of the Russian Federation).

Price of the apartment purchase and sale agreement can be determined:

- at the independent decision of the seller;

- by mutual agreement of the parties;

- based on independent assessment.

Independent assessment real estate makes it possible to find out the market value of housing, this procedure should be done in a number of cases:

- When selling, if, for example, an apartment has several owners and they disagree about its value.

- on property disputes.

- When applying for a mortgage, banks require documentary evidence of the price of housing.

- A loan or a loan from a banking institution, if the guarantee of loan repayment is a real estate property.

When determining the cost of housing on your own or by turning to the services of specialized organizations, it is important that the price of the apartment does not exceed by several times the average market value of real estate of the same type, otherwise the sale will be extremely difficult.

Is the deposit included in the price of the property?

Deposit- this is the amount of money that the buyer transfers to the owner of the property or his representative as payment under the contract.

Target making a deposit - securing obligations under the transaction, that is, confirmation by the buyer of his intention to formalize the purchase and sale agreement.

The law does not provide a uniform template for making a deposit, but there is a number of legal requirements for its correct transmission:

- The agreement on the deposit must be concluded in writing, regardless of the amount (Article 380 of the Civil Code of the Russian Federation).

- It is important to state that the transferred amount is precisely a deposit, and not, for example, an advance payment or advance.

- Receipt by the seller of the amount of money must be confirmed by a written receipt issued to the buyer.

By paying a deposit, the parties can confirm their obligations to conclude:

- Purchase and sale agreements.

- The main agreement on the terms provided for in the preliminary agreement (Article 429 of the Civil Code of the Russian Federation).

The deposit amount transferred upon concluding the main contract for the sale of real estate counted towards the total price of the apartment.

The law does not spell out the exact deposit amount which must be paid when purchasing a home, it is usually determined by agreement of the parties and is approximately 5-10% of the value of the property.

Change in the cost of an apartment under a purchase and sale agreement

When drawing up a purchase and sale agreement, the parties to the transaction in order to obtain a certain benefit may resort to various apartment price changes. These include:

- Overestimation of the cost of housing under the contract.

- Indication in the agreement of the reduced price of the property.

The change in the cost of the apartment can be regarded as criminal scheme, for example, on tax evasion, but will not have of great importance, which of the participants in the transaction initiated the proposal to change the cost of housing, each person is an accomplice.

Inflating or understating the price of property is a dangerous undertaking, even if bank employees do not object to such actions if they are involved in a transaction, for example, issuing a mortgage loan.

It's important to realize that change in housing costs may lead to a number of negative legal consequences. Before agreeing or proposing these deformations, it is worth considering all possible legal risks.

Reduced price in the purchase and sale agreement

The undervaluation of housing is said to be in cases where the purchase and sale agreement specifies a price that is significantly below average market value real estate object.

Selling property at a price lower than the actual price beneficial for the seller, which sells real estate on the secondary market if:

- The cost of the apartment is more than 1 million rubles.

- Possession does not exceed 3 years.

- For housing purchased after January 1, 2016, the period of ownership does not exceed 5 years.

The above conditions, together with the undervaluation of the property, allow the seller to significantly save on tax on income individuals(NDFL).

It may be beneficial for the seller to lower the price even in the event of a lawsuit. proceedings on property disputes.

Citizen N sold an apartment, indicating in the purchase and sale agreement the cost of housing is much lower than the amount he actually received. After which Citizen M, the wife of Citizen N, went to court, demanding that the transaction be declared illegal, since the property was acquired during marriage, and there was no consent for the sale. Citizen N proposed to conclude a settlement agreement by paying his wife half the amount of the income received from the sale. Citizen M accepted the terms of the settlement agreement, not suspecting that the price under the agreement and the actual enrichment of Citizen N differed significantly.

Officially reduced housing prices issued in the following way:

- The price of the apartment in the contract is indicated less than the actual cost.

- The remaining amount of money required by the buyer for the purchase is prescribed as the price for inseparable improvements, for example, or repairs.

If the cost of housing is underestimated, the buyer does not have any special guarantees and, in order to protect himself, he should contact the insurance company for insurance against the risk of possible loss of property rights.

If the bank lowers the price of an apartment with a mortgage

Nowadays, cases of underestimation of the cost of an apartment by parties to a transaction have become frequent; usually bank employees go to such lengths price changes, subject to the conditions put forward by them:

- Banks increase the amount of the down payment when receiving a mortgage loan.

- A banking institution may specify in the agreement with the borrower not the cost of housing, but the amount of the loan itself.

- The bank significantly increases the interest rate of the loan issued.

If the seller himself wants to fictitiously lower the price without notifying the bank about this, then such a trick is unlikely to be implemented, since when issuing a loan and mortgage, it is a mandatory step property valuation. Banks need a guarantee that the apartment, that is, the collateral, can, if necessary, be sold for an amount not less than the size of the mortgage loan.

Banking organizations have one or more partners - specialized companies in the field of housing assessment, and those who are borrowers of mortgage funds should contact these appraisal representatives.

Appraisers form report, which determines the market value of the property - based on this amount, the bank will calculate the size of the mortgage.

Reach agreement with appraisers on understatement of the market price of an apartment extremely difficult, since these organizations value their clients and good reputation.

Selling an overpriced apartment

Overpricing of housing usually occurs when carrying out a transaction to obtain a mortgage.

Main goals overvaluation may be:

- The buyer's desire to receive a large amount of mortgage funds. This is possible if the future owner of the property and the seller reach an agreement to stipulate in the contract a price higher than the one that will ultimately be transferred to the seller.

- If the buyer fails to pay mortgage payments, the bank. In this case, as a rule, a property is put up for auction at the price specified in the contract; the higher the price, the more profitable it is for the buyer.

In order to increase the price under the contract, it may not be enough to reach an agreement between the buyer and seller, since the cost of housing is determined by independent appraisers, and based on their assessment, banks transfer borrowed funds to the client.

Selling real estate with an inflated value is a process that involves various types of risks for each party. These types of transactions may be considered fraudulent schemes.

Risks of the seller and buyer when buying and selling housing at a non-market price

Selling a property at a non-market price can lead to a number of negative consequences for each of the parties to the transaction.

For the buyer risks may be of the following nature:

- When the price of an apartment is reduced, if the court declares the transaction invalid for any reason, the buyer has no guarantees. The apartment is returned to the seller in its entirety, and to the buyer the amount specified in the contract, since it is almost impossible to prove that the actual payment was higher.

- If the buyer decides sell in less than 5 years real estate that was purchased at a reduced price, he will have to pay a tax, which can be reduced by the amount of expenses incurred in purchasing this apartment, confirmed by documents. And the costs specified in the contract are underestimated.

The seller, by changing in one way or another the price established in the contract, can attract attention of tax authorities:

- If the cost of housing is significantly less than the market value, then the possibility of a tax audit is extremely high.

- Based on the results of the audit, the tax office has the right to accrue the missing amount of payments, as well as bring the person to justice due to tax evasion (Article 198 of the Criminal Code of the Russian Federation).

For parties to a purchase and sale agreement lending fraud, namely: theft of funds due to the provision of false, inaccurate information to the bank - may threaten criminal liability(Article 159.1 of the Criminal Code of the Russian Federation).

Receipt for the purchase of residential premises at an undervalued or inflated price

A receipt is a document that confirms partial or full fulfillment of an obligation under transfer of funds. This is a guarantee for the payer, establishing payment under the contract.

If the parties decide to indicate in the agreement an overestimated or, on the contrary, underestimated cost of residential premises, the question arises as to whether what amount should be written on the receipt?. A controversial point arises because it is unprofitable for the seller to indicate the real amount in the document, but it is important for the buyer to respect personal interests. In such a situation, the parties may use a trick and formalize two receipts:

- In the first property price matches with the one specified in the contract.

- The second document states the remaining amount of money, the purpose of which can be, for example, design decoration living space.

The receipt must be completed in writing, by hand and by the compiler himself, contain the amount of payment for the purchase, data on the housing itself, the date and place of drawing up the document.

It is important that the receipt indicates that the agreed amount transferred in full, and the recipient of the funds does not have any claims.

Accounting for cadastral value when selling an apartment in 2017

This is the price of an apartment, which is calculated by independent appraisers, at the initiative of government agencies. The information received is entered into cadastre of real estate objects.

The state carries out a cadastral assessment of housing, since given value taken into account for the following purposes:

- Taking out a loan to purchase an apartment from state banking institutions.

- Payments for transactions related to real estate (donation, purchase, sale).

- Calculation of payments when inheriting residential premises.

- Payment of property tax.

- Amounts of money when using an apartment on social rental terms.

The cadastral value of housing is calculated based on the following characteristics:

- Living area of the property.

- Location.

- Year of construction, type of housing (brick, panel, monolith).

- Development of the area's infrastructure.

- Market value of similar properties.

The cadastral value of real estate is not constant, it is updated and can be changed by the state, for example, due to general rising real estate prices.

Income tax and personal income tax deduction when selling an apartment

Based on the new rules for the sale of real estate from January 1, 2016, personal income tax (NDFL) is calculated based on on the cadastral, and not the inventory value of housing, which was used previously.

When calculating tax on income from the sale of real estate, it is necessary to proceed from following conditions:

- The personal income tax rate is 13%, and is calculated as a percentage of the value of the property sold.

- The cost of the apartment, determined in the purchase and sale agreement, cannot be less than 70% of the established cadastral value of this housing.

- When calculating tax, it is possible to use a property deduction - the amount by which a person has the right to reduce the tax payment, but not more than 1 million rubles.

Citizen P purchased an apartment in 2014, in 2016 he decided to sell the property for 3 million 500 thousand rubles, the amount of tax that must be paid to the budget is calculated as:

(3,500,000 - 1,000,000) × 13% = 325 thousand rubles.

The property deduction is provided once in a lifetime; if a person has already used such a right, then the personal income tax will be calculated as 3,500,000 × 13% = 455,000 thousand rubles.

After January 1, 2016, in order not to pay personal income tax, a citizen must own an apartment more than five years, and not three, as was previously provided.

Sale of housing at a price below or above the cadastral value

State cadastral valuation is carried out based on the market value of the property and other information about the property (floor, area, location).

Main differences cadastral value from the market value are as follows:

- The cadastral value is required mainly for calculating tax payments.

- Cadastral valuation is carried out by a professional appraiser hired by the state, based on statistical analysis and mathematical methods.

- The market price is usually determined by the owner himself or an independent appraiser, based on the cost of similar real estate.

By analyzing market prices, specialists establish a cadastral value close to market. But due to the likelihood of errors, deviations in market and cadastral values do occur.

If the owner of the apartment does not agree with the cost of housing indicated in the cadastre, he has the right challenge in court this value.

How to find out the cadastral value of an apartment?

Anyone can find out the cadastral value willing. There are several ways to clarify this information:

- On the official website of the tax service, when the person knows the cadastral number of the property.

- If the apartment number in the cadastral register is not known, you can clarify the necessary information on the website Federal service state registration, cadastre and cartography (Rosreestr), where you will need to indicate the address of the apartment.

- Personal application to the Rosreestr branch or to the multifunctional center for the provision of state and municipal services (MFC).

A homeowner who already has a cadastral passport should know that its validity period is unlimited, but the information contained in the document may be irrelevant, since the assessment activities are repeated at least once every five years.

In order to update the information written in the cadastral passport, a citizen has the right to order certificate(to do this, you should contact the local branches of Rosreestr or MFC).

If the owner has carried out legal redevelopment apartments, then information about the changes should be reported to the territorial body of Rosreestr, and then received new cadastral passport.

Conclusion

The process of buying and selling a home involves a lot of problematic aspects:

- execution of the contract;

- determining the price of a property;

- making a deposit;

- establishing the cadastral value of the apartment;

- calculation tax contributions to be paid.

It is not uncommon for parties to change the cost of housing according to various reasons. Both the owner of the apartment and the future owner underestimate or, on the contrary, want to inflate the price of the property. Such actions may be regarded as fraudulent schemes and entail punishment, including criminal liability. Therefore, when concluding a purchase and sale agreement, the parties should approach it with particular care. competent design, complying with the requirements of current legislation.

Question

Consequences of concluding a transaction with undervaluation of housing

I want to buy an apartment, but the seller of the property I like offers to indicate in the purchase and sale agreement a price that is lower than the amount I have to pay for the purchase. This is beneficial for the seller, since the amount of tax that he needs to pay after the sale of the property will be significantly lower, and after payment he will give me two receipts, one of which will indicate the amount under the contract, and the second will contain the balance of the payment I made for integral home improvements. Tell me, what consequences might the conclusion of such a deal have for me?

Answer

The scheme you indicated is illegal, liability for tax evasion is provided for in the criminal legislation of our country, the buyer can be recognized as an accomplice of the seller, and the issued receipts will confirm the tax violation. If for some reason the transaction is declared invalid in court, then you risk not returning the amount indicated in the second receipt.Money is considered the most liquid commodity. Either because of their quick liquidity, or because of a lack of funds, situations arise when this same money becomes needed very urgently. A way out of the situation may be to go to a pawnshop. You can pass jewelry without return or buy them back after some time.

Of course, the amount of proceeds from the delivery of silver will be significantly lower than from the delivery of gold. As of 04/27/16 average cost 1 gram of gold is 2637 rubles, and 1 gram of silver is 36.22 rubles. This significant difference is explained by the high percentage of impurities in the composition silver products and their low market value.

Purchasing silver items is often not profitable for pawnshops. Therefore, if you are planning to take your silver to a pawnshop, the price per gram should not shock you - this is the maximum you can get.

The cost of silver in a pawn shop

The price of silver in a pawn shop per gram is determined by stock quotes, the jewelry value of the product and its fineness.

An important factor in determining the price is the artistic value of the item. If this is an antique item, the conditions for its delivery are somewhat different from the standard ones. In this case, you should contact a specialized pawnshop. The most popular and expensive is considered 999 silver. But others are also quoted: 800, 916, 910, 925.

The common 925 is found quite often. You will receive more accurate information about how much it costs to hand over 925 silver to a pawnshop at a specific institution for the purchase and sale of valuable items and goods. On average, prices are at approximately the same level, so you need to start from 36 rubles. for 1 gram of silver.

How to donate silver to a pawnshop?

The process itself is very simple and takes very little time. You need to decide which product you will hand over, and whether you plan to buy it back. A passport is required to complete the transaction. The price of silver in a pawnshop depends on the condition of the item, weight and delivery conditions. The appraiser classifies and describes the product, determines whether it is a full-fledged one or a scrap of precious metals. The product must withstand the test; if it is complete, there should be no chips, cracks, soldering, or deformations.

The weighing takes place in your presence and the loan amount is determined. Then you will need to sign an agreement on accepting the collateral and issuing funds, which stipulates the terms, dates, cost, and interest rate for using the pawnshop’s money. After this, you receive the agreed amount and a copy of the contract. The loan amount depends on the estimated value of the product. Cash loan is provided for a term of up to one year; some pawnshops establish an unlimited term for using the loan.

Further options

If you needed to hand over the silver to a pawnshop without subsequent redemption, then in this case no further action is required. If you have handed over silver for a while, it is worth keeping the pawn ticket until you buy back your item. For using money you will need to pay interest; on average, the monthly interest rate is 5-7%. Many pawnshops meet their customers halfway and extend the term of the contract. In this case, you just need to continue paying interest for using other people's money.

After the grace period under the contract ends, the item becomes the property of the pawnshop. In the future, you can purchase it on free sale, but at new value. The new price of silver in a pawnshop per gram is set by the institution itself; it is usually higher than the collateral value, but lower than the market price.

Let's give a specific example

Let's say you want to hand over silver to a pawnshop, the price per gram is about 30 rubles, depending on the sample.

Let's take a marketable ring in excellent condition as an example. If the item is 925 and its weight is 3.5 grams, the estimated cost of the ring will be 105 rubles, and the loan amount will be approximately 75 rubles. To use the loan you will need to pay about 5%, which is 3.75 rubles per month. It turns out that if you buy it back in a month, then for using the loan you will need to pay the loan amount and a small percentage. Using this example, you can calculate how much it costs to hand over silver to a pawnshop specifically for your case.

When choosing a pawn shop, the price per gram of silver is very high level should alert you. The safest thing to do is to contact network companies that have been providing buying and selling services for a long time. This way you will insure yourself against possible risks of fraudulent activities, receive a true assessment of products and transparent conditions cooperation.

| Nomenclature | Individuals | Legal entities | |

| cash price | price by bank transfer | price by bank transfer | |

| Copper-brass group | |||

| Copper mix (NOT SORTED) | 343 rub. | 353 rub. | 363 rub. |

| Copper shine | 360 rub. | 370 rub. | 380 rub. |

| Copper piece | 348 rub. | 358 rub. | 368 rub. |

| Tinned copper (BURNED WASTE) | 330 rub. | 340 rub. | 350 rub. |

| Copper (electrotech shank rod, shiny in oil) | 348 rub. | 358 rub. | 368 rub. |

| Copper grade (burnt) from 0.5 mm | 348 rub. | 358 rub. | 368 rub. |

| Copper shavings | 305 rub. | 315 rub. | 325 rub. |

| Bronze | 235 rub. | 245 rub. | 250 rub. |

| Brass | 200 rub. | 205 rub. | 210 rub. |

| Brass radiators | 205 rub. | 210 rub. | 215 rub. |

| Brass shavings (blockage from 5%) | 175 rub. | 185 rub. | 190 rub. |

| Aluminum group | |||

| Aluminum mix | 69 rub. | 71 rub. | 73 rub. |

| Electrical aluminum | 100 rub. | 102 rub. | 104 rub. |

| Food grade aluminum | 92 rub. | 94 rub. | 98 rub. |

| Aluminum can (summer reception conditions) | 61 rub. | 63 rub. | 64 rub. |

| Aluminum profile | 88 rub. | 90 rub. | 92 rub. |

| Aluminum motor | 69 rub. | 71 rub. | 73 rub. |

| Aluminum shavings (clogging from 5%) | 40 rub. | 42 rub. | 42 rub. |

| Lead-tin group | |||

| Flooded batteries (ebonite) | 45 rub. | 46 rub. | 46 rub. |

| Batteries (gel, polypropylene) flooded | 59 rub. | 61 rub. | 62 rub. |

| Lead in sheath | 112 rub. | 114 rub. | 116 rub. |

| Lead remelting | 107 rub. | 109 rub. | 111 rub. |

| Lead typographic | 75 rub. | 77 rub. | 77 rub. |

| Tsam (clean) blockage 0.5% | 100 rub. | 103 rub. | 105 rub. |

| Tsam (not collapsible) blockage 10% | 100 rub. | 103 rub. | 105 rub. |

| Zinc (plumbing) blockage 3% | 100 rub. | 103 rub. | 105 rub. |

| Nickel group | |||

| N/C 10% (NI from 9.3%) | 68 rub. | 70 rub. | 72 rub. |

| N/C 9% (NI from 9-9.2%) | 63 rub. | 65 rub. | 67 rub. |

| N/C 8% (NI from 8-9%) | 55 rub. | 56 rub. | 57 rub. |

| N/C 7% (NI from 7-8%) | 40 rub. | 41 rub. | 42 rub. |

The best price for receiving non-ferrous metals

The NZ Metal company accepts from the population, as well as from legal entities, non-ferrous metal for its subsequent processing. One of the most attractive factors for clients is our price for receiving non-ferrous metals.

What determines the price of receiving non-ferrous metals?

The price offered by our company is well thought out and structured. To find out how much scrap metal intended for sale is worth, first of all it is necessary to determine what type it belongs to in its composition, that is, which metals and in what percentage contains. These could be groups such as:

- more expensive copper-brass;

- average price aluminum;

- nickel, the value of which is slightly lower.

The payment amount is also affected by:

- volume of accepted metal;

- quality characteristics, presence of impurities and contaminants, thickness (if we are talking about cable);

- seller status (provided interesting conditions for enterprises);

- form of payment (non-cash payment method is more profitable).

Since the price for purchasing non-ferrous scrap is determined by several factors, the final cost is calculated individually in each case.

How to find good prices for non-ferrous scrap

To afford sufficiently high purchase prices, a company needs to:

- to be a large company practicing a European approach to the issue of collecting recyclable materials;

- save by optimal size rent (located, for example, not in the center of Moscow, but in the near Moscow region);

- enjoy a strong reputation, as well as an established network for the further sale of metal and the results of its processing.

Possessing all these characteristics, the most interesting for potential clients The licensed company NZ Metal can offer prices for a collection point for non-ferrous metals.

LLC "NZ Metal" - prices for non-ferrous metal collection point and other advantages

With modern competition in this market segment, the popularity of a company depends not only on the price of non-ferrous scrap. The NZ Metal company offers its clients and partners such advantages as:

- a well-located modern scrap metal collection point;

- convenient operating mode (daily);

- services of well-trained personnel:

- responsible and attentive attitude.

Our prices are regularly updated; you can check the current cost of non-ferrous scrap using:

- information on our website;

- telephone consultation with managers.

The tested scrap metal that we buy is invariably suitable for further recycling in various industrial and economic fields.